|

The Internet of Things

IoT Spending Remains Strong

About This Report: A November survey of 451 Global Digital Infrastructure Alliance members (n=1,091) focused on the Internet of Things (IoT) – including IoT spending plans, big data, types of initiatives and most-important vendor attributes.

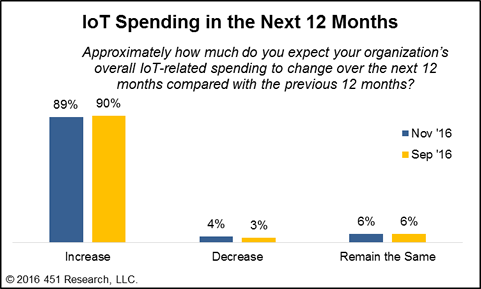

IoT Spending. Spending on IoT remains strong, with 89% of respondents saying their organization’s IoT-related spending will increase over the next 12 months (down 1-pt from previous), versus only 4% expecting a decrease (up 1-pt from previous).

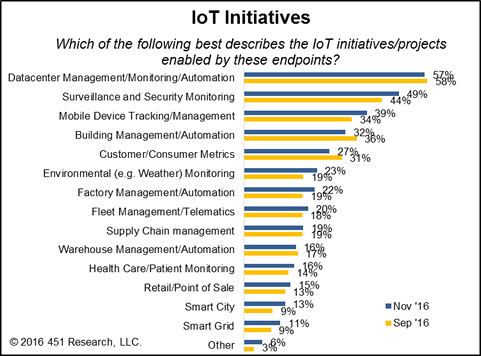

Types of IoT Initiatives/Projects. Datacenter Management/Monitoring/Automation

(57%, down 1-pt from previous) remains the top IoT initiative. Surveillance and Security Monitoring (49%) and Mobile Device Tracking/Management (39%) initiatives are also common and have both increased 5-pts from the previous survey.

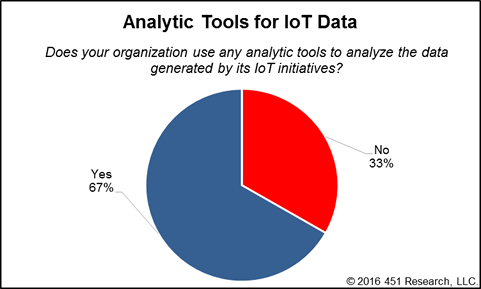

Analyzing IoT Data. The majority of respondents (67%) are using analytic tools to analyze the data generated from their IoT initiatives. One-third of the respondents (33%) are not.

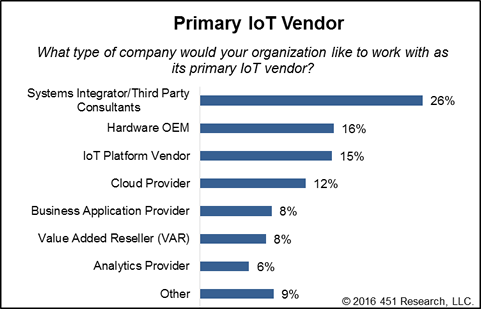

Primary IoT vendor. One-quarter of respondents (26%) chose Systems Integrator/Third-Party Consultants. Hardware OEM (16%) and IoT Platform Vendor (15%) are a more distant second and third.

|

By Tracy Corbo

451 Research defines an Internet of Things initiative as a project that gathers data from embedded sensors and circuitry (in factory machinery, cameras, field equipment, etc.) or end-user devices (e.g., smartphones, tablets, wearables, etc.), and uses that data to optimize business operations, enhance customer targeting/increase sales, reduce risk or create new products/services.

IoT Spending – Next 12 Months

Spending on IoT remains strong, with 89% of respondents with IoT initiatives saying their organization’s IoT-related spending will increase over the next 12 months (down 1-pt from previous), versus only 4% expecting a decrease (up 1-pt from previous).

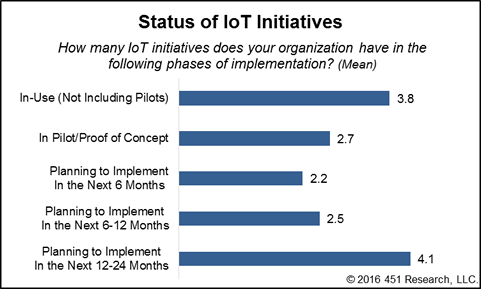

Status of IoT Initiatives

To better understand the progress of IoT initiatives within organizations, respondents were asked how many IoT initiatives their organization has in various stages of implementation. The average number of IoT initiatives currently in use across all organizations is 3.8, with another 2.7 in pilot/proof-of-concept phase.

Considering upcoming IoT plans, respondents report an average of 2.2 implementations in the next six months, 2.5 in six to 12 months, and another 4.1 additions over the next two years.

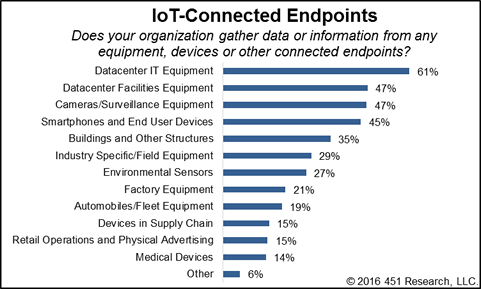

IoT Endpoints

Looking at the respondents who collect data from endpoints, Datacenter IT Equipment

(61%) remains the most common source of IoT data, followed by Datacenter Facilities Equipment (47%) and Camera/Surveillance Equipment (47%).

Types of IoT Initiatives/Projects. Datacenter Management/Monitoring/Automation (57%, down 1-pt from previous) remains the top IoT initiative. Surveillance and Security Monitoring (49%) and Mobile Device Tracking/Management (39%) initiatives are also common and have both increased 5-pts from the previous survey.

In contrast, Building Management/Automation (32%) and Customer/Consumer Metrics

(27%) have decreased slightly (4-pt decrease).

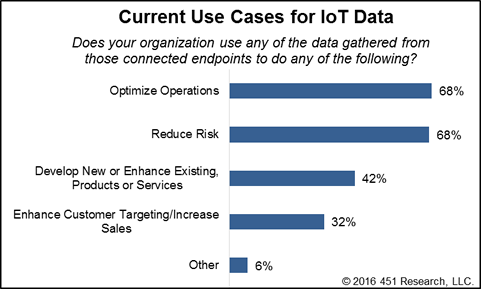

Uses of IoT Data. The top reasons for gathering endpoint data are to Optimize Operations (68%) and Reduce Risk (68%). Other important reasons are to Develop New or Enhance Existing Products or Services (42%) and Enhance Customer Targeting (32%).

IoT Networks

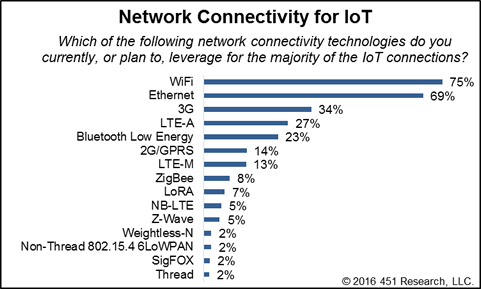

In terms of the types of networking technologies that respondents are currently leveraging, or plan to make use of, for their IoT connectivity, Wi-Fi (75%) and Ethernet (69%) are the dominant technology platforms.

Cellular mobile technologies 3G (34%) and LTE-A (27%) are a more distant third and fourth.

IoT and Big Data

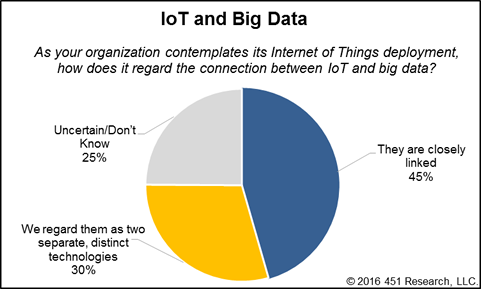

Respondents were asked if they believe there is a connection between IoT and big data, and 45% of respondents consider them closely linked. Another 30% regard them as two separate and distinct technologies. One-quarter of respondents said they did not know or were uncertain.

Analyzing IoT Data. The majority of respondents (67%) report that their organization is using analytic tools to analyze the data generated from their IoT initiatives. One-third of respondents (33%) are not currently using analytic tools to analyze the data.

Vendors Supporting IoT Initiatives

Respondents were asked questions regarding the various types of vendors supporting their IoT initiatives.

In terms of which type of vendor they view as primary for IoT, one-quarter of respondents (26%) say Systems Integrator/Third-Party Consultants. Hardware OEM (16%) and IoT Platform Vendor (15%) are second and third.

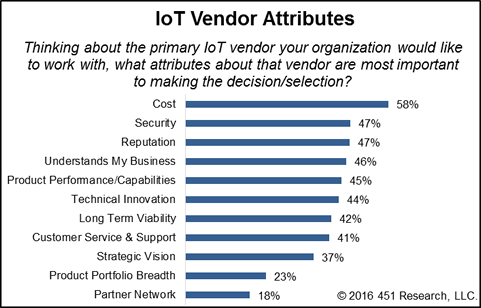

IoT Vendor Attributes. While Cost (58%) is a major factor when choosing an IoT vendor, several other attributes – including Security (47%), Reputation (47%), Understands My Business (46%), Product Performance/Capabilities (45%) and Technical Innovation (44%) rank within a 3-pt spread of each other.

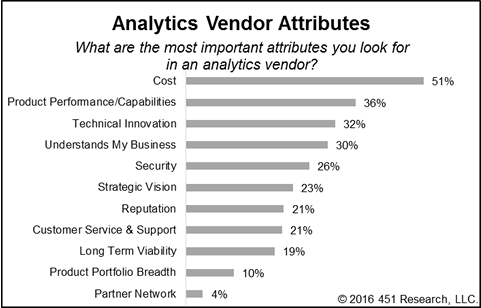

Analytics Vendor Attributes. Cost (51%) is also a top attribute when it comes to analytics vendor selection, but Product Performance/Capabilities (36%) stands alone in second and Technical Innovation (32%) is third.

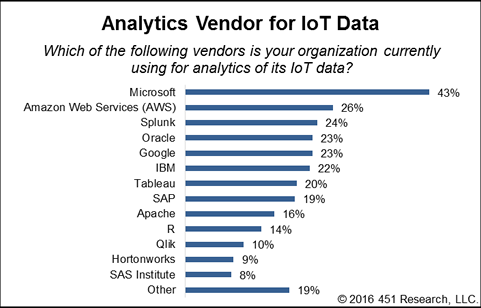

Analytics for IoT Vendor. As far as which vendor respondents are currently using for analytics of their IoT data, Microsoft (43%) is the most popular, distantly followed by Amazon Web Services (26%) and Splunk (24%).

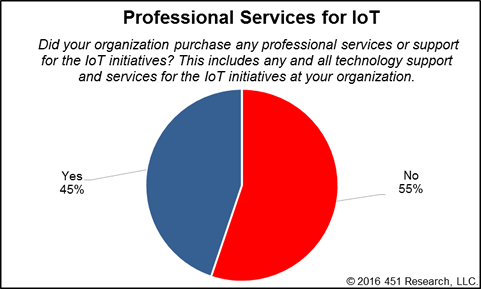

Professional Services for IoT

Respondents were asked whether their organization purchases professional services for IoT initiatives. While 45% of respondents purchased professional services or support for their IoT initiatives, 55% did not. Organizations with more than 10,000 employees were more likely to purchase professional services (61%) than smaller organizations.

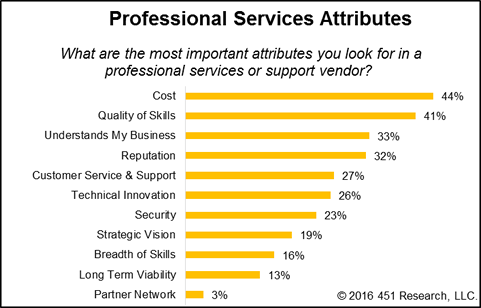

Professional Services Vendor Attributes. Once again, Cost (44%) is the top attribute for the selection of professional services vendors, but Quality of Skills (41%) is a very close second. Understands My Business (33%) is third.

You can access a PDF version of this 451 Alliance report here.

If you have any questions about your 451 Alliance membership, please contact 451Alliance@451Research.com

451 Research, LLC does not make any warranties, express or implied, as to the information presented in this report.

|